It is broadly accepted that reducing carbon emissions is the right response to climate change. We are now also facing ever-rising costs of living and doing business, resulting in a growing hunger to unlock the significant financial savings that can be achieved by shifting to renewable energy. As such, completely changing to tools and methods that can be powered by electricity, as opposed to liquid fossil fuels, and using renewable resources, such as solar and wind, to generate the required electricity is now a no-brainer. However, this shift to renewable energy is not easy to implement.

The predominant implementation thinking is to generate more solar and wind energy than we need when the resources are abundant, and use other technologies to store the excess energy for dispatch during times when the supply from renewable resources is lower (i.e., during the windless, cold, and dark days and nights). The first part – installing a lot of solar and wind – makes sense. However, placing a lot of reliance on energy storage is where we’re bound to come up short. Here’s why.

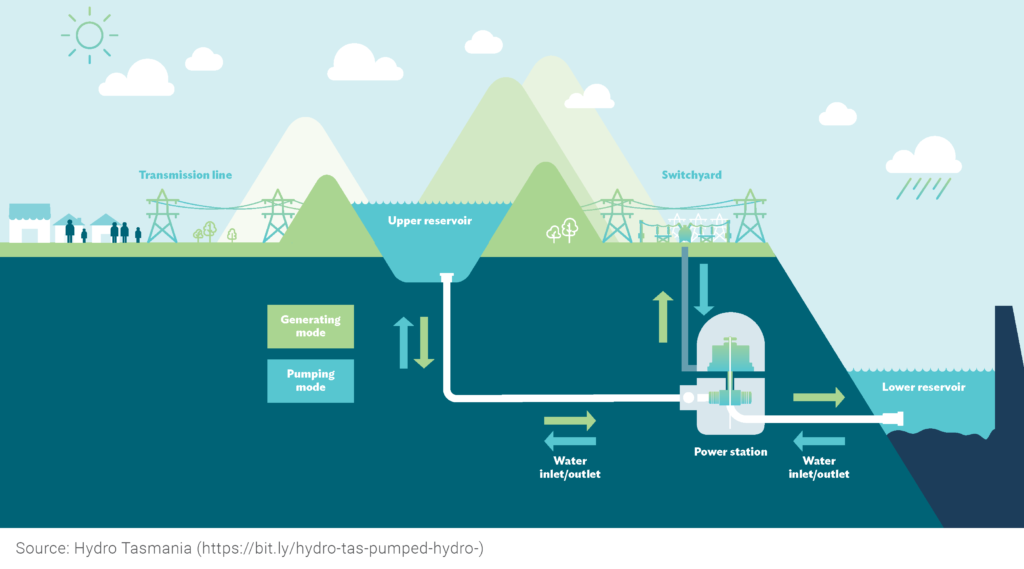

Pumped-hydro energy storage is proven but it isn’t widely available

Pumped-hydro provides most of the grid-scale energy storage, representing over 97% of installed energy storage capacity globally. There is good reason for this. It is by far the most mature storage method and the cost can be attractive. However, it requires a specific type of site, one with two large bodies of water near to each other horizontally, while separated by as much vertical distance as possible. Sites with these specific characteristics are relatively few and far between, and there certainly aren’t enough of them in all of the places we’d need them if we are going to rely solely on this technology.

Grid infrastructure must be upgraded before a near seamless integration of utility scale storage is possible

When confronted with the reality that pumped-hydro storage requires specific site characteristics, typically the first thought is still to build this infrastructure where we can and then transport the stored energy via the grid to where it’s needed – predominantly urban hubs and large cities. However, the development of the grid required to facilitate this will take a lot of time.

This is because for many decades, electricity has been generated predominantly from coal, and coal is easily transported. Power generation facilities were therefore built close to the major load centres (i.e., towns and cities). The second order effect of this is that grid infrastructure was built out on the basis that most power generation facilities could be located near major load centres. This legacy grid infrastructure design is now at odds with where renewable resources are typically available – usually in remote, outlying areas away from the major load centres. The immensity of this grid infrastructure upgrade cannot be underestimated, and it will take decades to fully materialise.

Other energy storage technologies are immature and costly

If we can’t integrate pumped-hydro at scale, surely there are other storage technologies – like batteries – that we can install where we need energy storage? Well, if we can get enough lithium out of the ground, which is highly unlikely, then yes, we could do this. But even if we can access enough materials, this form of storage is still expensive, and it does not allow for the long storage durations needed to see us through the periods when renewable resources are more scarce.

Other technologies, such as gravity energy storage, show significant potential. Based on similar principles to pumped-hydro, this technology substitutes water with physical blocks of mass that are raised and lowered for storing and discharging energy. It has the potential to provide low cost, long duration, and long lifetime storage and comes with lower technology risk than other electrochemical battery technologies being investigated because it relies on tested and proven components (cranes and winches). Additionally, this technology is not as dependent on specific site characteristics, like pumped-hydro, and therefore holds a lot of potential. However, its development is still in the early stages, with the first (small) full-size (4-8MW) fully operational facility scheduled to come online in 2026.

What should we do?

Both solar and wind energy generation technologies are mature and provide complimentary supply curves and significant cost savings. In many parts of the world, it is cheaper to build new renewable energy plants than it is to run and maintain existing coal-fired plants. We should therefore move forward with installing as much solar and wind generation as supply chains can support. To account for the intermittency of renewables and ensure maximum penetration, we should also aim to install energy generation potential that is at least 50% larger than the demand requirement. That way we will almost always have renewable energy available to supply the demand, even during darker, windless periods.

What then do we do with the excess energy available when solar and wind resources are most abundant? Surely, the funders of these facilities will want to know that all the energy they produce will be paid for? These are good questions.

A solution that could monetise the excess and otherwise stranded renewable energy is bitcoin mining. These facilities are a unique buyer of excess renewable power for several reasons:

- Their load is interruptible. Bitcoin mining is not a sequential industrial process and can therefore be turned on and off quickly and easily, even via remote operation, immediately generating income when switched on, while also easily removing load if necessary.

- They can be co-located, at the power source, removing reliance on grid infrastructure. As long as there is an internet connection, their load is location agnostic, enabling use of otherwise stranded power at the generation site. It also does not need to be in close proximity to off-takers, pipe infrastructure, or water.

- Their load is modular. It can be applied by joining together standardized units to form larger or smaller compositions that, in a piece-by-piece manner, can operate on intermittent power.

- The equipment is portable with a compatible footprint. It can be relocated if and when required and would leave behind similar electrical infrastructure needed for on-site energy storage.

- It is commercially viable even if a lower capacity factor is preferred. The capital requirement is viable from a risk-adjusted returns perspective, with typical project paybacks of ~5 years.

Bitcoin miners receive newly ‘minted’ bitcoin as well as any transaction fees paid in bitcoin by users of the network. Bitcoin is accepted globally and can be sold for other currency (e.g., USD) 24/7, 365 days a year.

Although the purchasing power of bitcoin is volatile, this volatility is accounted for. For more than 12 years bitcoin’s risk-adjusted returns over any 4-year period have been better than US Stocks, US Real Estate, and all other publicly available investment alternatives. Furthermore, there are now numerous bitcoin mining companies listed in jurisdictions such as the United States and Canada with valuations of more than a billion US Dollars.

Decarbonization this decade is a significant opportunity, but it requires innovation. Bitcoin mining with renewable energy is technically feasible and financially viable today; let’s embrace it and take a significant step towards decarbonization.

This is just one innovation that could unlock exponential growth for those bold enough to capitalise on the forces shaping the future. Futureworld has decades of experience working with our clients to understand those forces and the opportunities they present. If you’d like to explore the forces shaping the future of your business, reach out to us.

About the Author

Grant Ralph is an Exponential Growth Leader at Futureworld. He is passionate about strategy formulation and developing new businesses. As a qualified attorney, Grant has a unique perspective on business and strategy development. He has led large-scale programs across muliple industries, from financial services to energy.

Connect with Grant on LinkedIn.

- Articles