SUMMER OF SUPER SURPLUS

Commodity prices hit 60-year lows as oil halves

- Dateline

- 4 July 2016

The world is awash with basic commodities, and for many people, prices have not been so low in living memory. It’s back to the 1950’s in real terms for resources like coal and iron ore; wheat and corn are dirt cheap too.

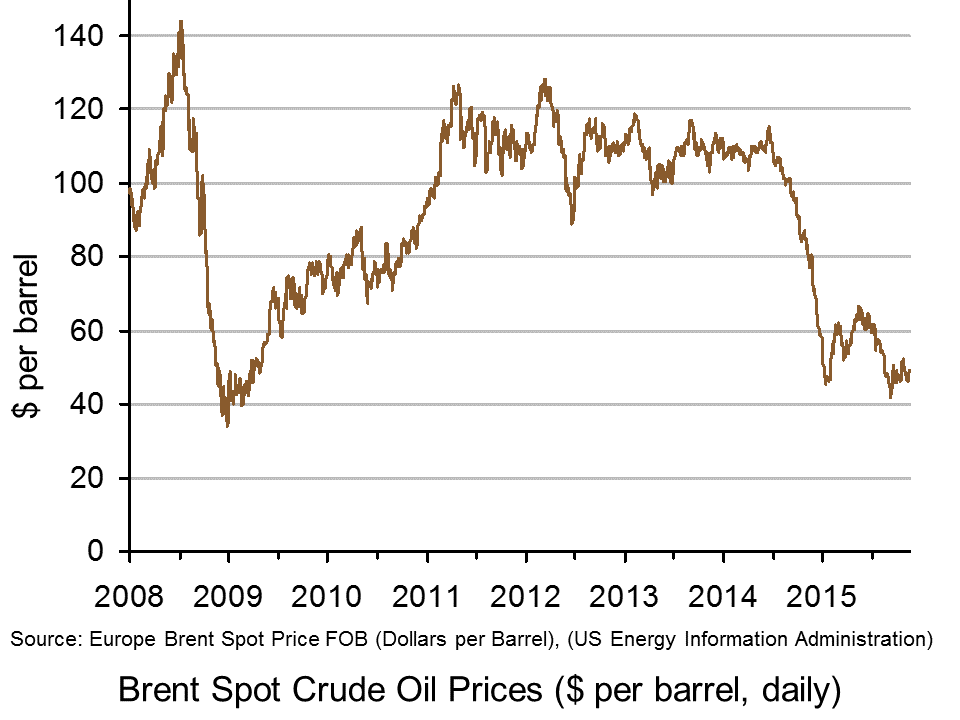

Fueled by fears of climate change and radical new energy and transport technologies, oil has halved in a year and is now floating around US$ 20 per barrel. Supply continues to exceed demand worldwide, as producers fight for market share.

Global electricity prices have continued their 200-year exponential decline in real terms. Day-time solar power in Australia, Spain and California is often free as output exceeds take-up in peak sunshine hours.

“If we look back far enough,” says futurist and business strategist Doug Vining, “then we see technology driving down real prices of everything, including food, despite the population explosion. The recent ‘super cycle’ boom in commodity prices was an aberration, not the underlying megatrend.”

The industrialization of China was the big thing driving commodities up. Now that China has stabilized as a mainly middle class, consumer society, that cycle is over. Scarcity of resources is an obsolete idea.

Exponential thinking, mainly driven by technology, is leading us into the age of abundance. That’s not good news for everyone; resource producers like Russia, OPEC and many African countries are taking a big knock. They will have to re-invent themselves as service or valued-added economies.

Consumers are enjoying low prices and input costs, but some are wondering how long this honeymoon will last!

ANALYSIS >> SYNTHESIS: How this scenario came to be

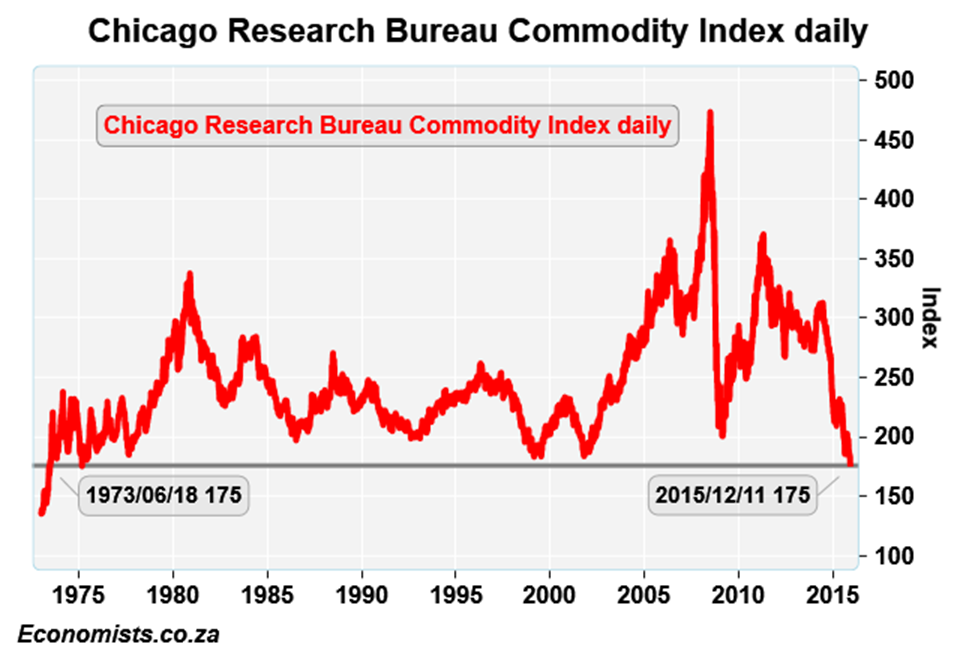

In December 2015 the Chicago Commodities pricing index drops to it’s lowest level in 42 years. This is not a spike downwards, but rather a sign that the commodities boom called the Super Cycle is over, and scarcity is giving way to a glut, worldwide.

Source: Moneyweb

At the same time, OPEC decides to defend its market position by continuing to pump oil faster than the market can absorb it. Prices continue to slide.

Source: Pearson blog

As Mike Shussler says, the world has got more stuff than it needs, or wants to buy, so prices are falling. Will this be consumer heaven, or a honeymoon that is unsustainable?

Links to related stories

- Oil producers prepare for prices to halve to $20 a barrel - Guardian, 8 December 2015

- The big price plunge - Mike Schussler, 15 December 2015

- MindBullet: THE CHINA ASSET BUBBLE BURSTS (Dateline: 12 October 2011, Published: 03 December 2009)

- MindBullet: THRIVING ON INEVITABLE DUALITY (Dateline: 1 June 2030, Published: 18 July 2013)

- MindBullet: GOLD AT $800, OIL AT $64 (Dateline: 6 November 2016, Published: 20 November 2014)

Warning: Hazardous thinking at work

Despite appearances to the contrary, Futureworld cannot and does not predict the future. Our Mindbullets scenarios are fictitious and designed purely to explore possible futures, challenge and stimulate strategic thinking. Use these at your own risk. Any reference to actual people, entities or events is entirely allegorical. Copyright Futureworld International Limited. Reproduction or distribution permitted only with recognition of Copyright and the inclusion of this disclaimer.