Innovation is key to success in a world of disruption. As Louis Geeringh, Futureworld International Chairman, said in a recent article about the changing rules of capital markets, change is inevitable and the rate of change is increasing exponentially. Like being on a raft in the middle of a raging ocean, when going through massive disruption, it’s often difficult to see beyond the next wave, and staying afloat becomes all-important. But, with the benefit of hindsight, the signals are clear.

Take the S&P 500 for example. Consider the companies that made up the S&P 500 over the last few decades, and you’ll see a clear demonstration of shifts in the economy and the importance of innovation. In the 1980s, 7 out of 10 of the biggest stocks were in the Energy sector, and there was only one listed technology company – IBM. Today, Energy has reduced to less than 4.5%, while the Technology sector represents over 26%.

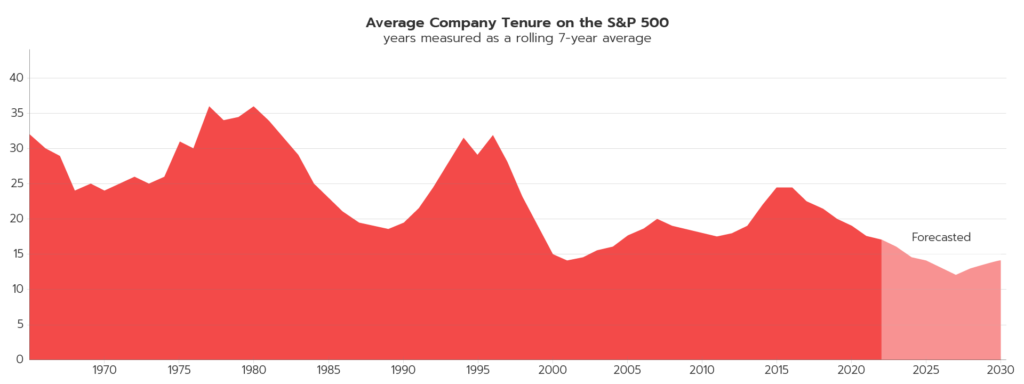

The links between economic volatility and change and company success are indisputable, and we can clearly see this play out in how long companies remain on the S&P 500. Over the years, the average tenure of companies on the index has ranged from 36 years in the 1970s to around 21 years in 2021, but forecasts have that pegged to fall to just over 14 years by 2030.

How innovation impacts S&P 500 tenure

Riding the crest of the innovation wave is indeed possible – just look at the some of the highest valued companies on the index – Apple, Microsoft, Google’s parent company Alphabet, Amazon, Tesla, Nvidia, and Meta – owners of Facebook, Instagram, and WhatsApp. What all of these companies have in common is that they don’t have a single ‘core business’ or exclusively operate in a single industry – they exist at the nexus of multiple industries, unlocking innovation and exponential opportunity.

If Apple had stuck to its ‘core business’ of computer manufacturing, we could still be carrying around a Sony Walkman, dreaming of a time when music would be more accessible. Actually, strike that. No we couldn’t. Some other company fuelled by innovation would have come along and done what Apple – and later, Spotify – did, but the top spot on the S&P 500 would have been held by someone else, that we know.

Regardless of whether your business is a listed entity commanding hefty premiums to its intrinsic value, or a start-up with big dreams, the fact remains; without innovation, your company will stagnate and ultimately die. To avoid following in the footsteps of the Eastman Kodaks of the world you need to understand the market forces that are so dramatically shaping the future, then design an exponential growth strategy uninhibited by a definition of ‘core business’ that will quite possibly be irrelevant 10 years from now.

With a vision of your business of tomorrow and a partner to help you implement it, exponential growth is within reach. We, at Futureworld, have decades of experience powering innovation; helping business leaders understand the forces shaping the future and building game-changing new businesses. If you and your executive team believe your role is to create the business of tomorrow, as opposed to simply operating the business of today, get in touch.

- Articles